Benefits of Salesforce for Insurance Companies

Insurance companies need to lay more focus on providing an excellent customer experience due to high competition. Missing/misleading data and disconnected systems are the root cause of failure in offering a seamless and efficient policyholder experience.

Let us discuss how CRM software like Salesforce can help you improve the policyholder’s customer experience.

Role of Salesforce CRM in Enhancing Customer Experience

Customer Relationship Management (CRM) software is an effective tool to manage, store, and share complex data of enterprises. It enables you to effectively handle centralized customer data and use the same across all channels, teams, and departments.

Insurance Companies can utilize one of the leading CRM software: Salesforce for this task. It helps reduce costs and complexities by ensuring that data flows from the primary source, through underwriting, to policy administration & claims.

Let us see how it can help insurance companies deal with changing customer experience:

1. Marketing

Marketing is one of the toughest and most tedious processes in any enterprise, especially when it comes to Insurance companies. You must already have an idea about how insurance companies run their ineffective marketing campaigns.

Salesforce Marketing Cloud can be an efficient tool to deal with the same as it eases the process of marketing and enables your organization to invest enough in marketing. If your company is looking to transform its regular marketing approach, Salesforce can be a great fit.

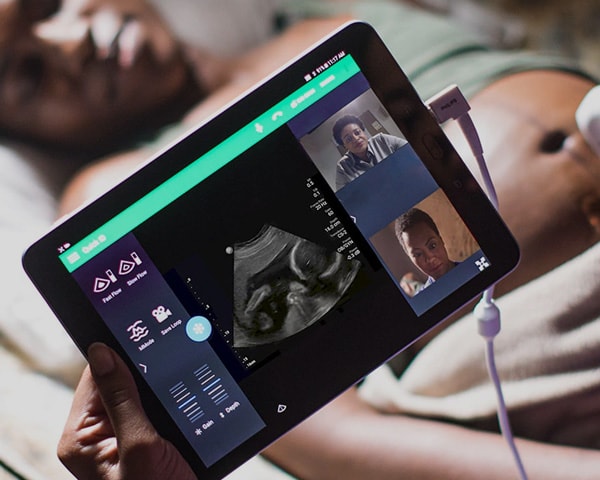

2. Real-Time Agent Communication

A flawless and quick conversation is required between the agent and policyholder/colleagues for a smooth flow of operations. Salesforce is a self-sufficient tool that eliminates any possible hindrance in the communication process and facilitates lower handling time.

Salesforce enables insurance agents to sync their data with their platform and makes this data easily available for sales representatives. Further, it also provides them with an option to develop custom dashboards for their clients. This dashboard helps in improving services by keeping clients updated with all the necessary information on time.

3. Smoother Claim Management

One of the most common issues for any insurance company is going through the claim management process. According to policyholders, speed matters a lot in claim settlements. On the other hand, the insurance industry manages complex client data from various sources. These tasks need to be performed with perfect accuracy.

Salesforce lets insurance companies achieve all these targets by efficiently handling claim management. Superb data collection and sorting facilities provided by the platform make it the most suitable tool for Insurance organizations. Altogether, it accelerates the process of claim settlement and at the same time prevents fraud claims.

4. Enhanced Customer Insights

You get enhanced customer insights with Salesforce which helps you generate more business. It offers a 360-degree view of customers that facilitates cross-sell and upselling.

This will increase your income from each customer and your organization will have a better understanding of its customers. Further, opting for Salesforce also assists Insurance companies in developing good customer relationships.

We hope this comprehensive guide helped you understand the various benefits of Salesforce for Insurance Companies. Salesforce offers profuse tools and functions to ease the day-to-day operations of insurance companies and help them save time by providing a digital platform.

Having troubles with Salesforce implementation for your business?

Tech9logy Creators is regarded as a top Salesforce Development Company in India. We own a dedicated team of professionals who aim to deliver the best solutions for your problems.

Contact us today to discuss your requirements and issues.