Description

Magento 2 Indian GST Extension

The Indian government introduced the Goods & Service Tax to ease calculating taxes levied on all types of goods and services. However, this presented the tedious process of manually calculating the GST levied on each product listed in every Magento store.

Indian GST, a powerful extension from Tech9logy Creators lets you automate GST rules creation and implementation with ease. All you need to do is configure our Indian GST extension based on the defined tax rule and modify the business origin. After this, the extension works to automatically calculate & display GST details on all orders placed from your store.

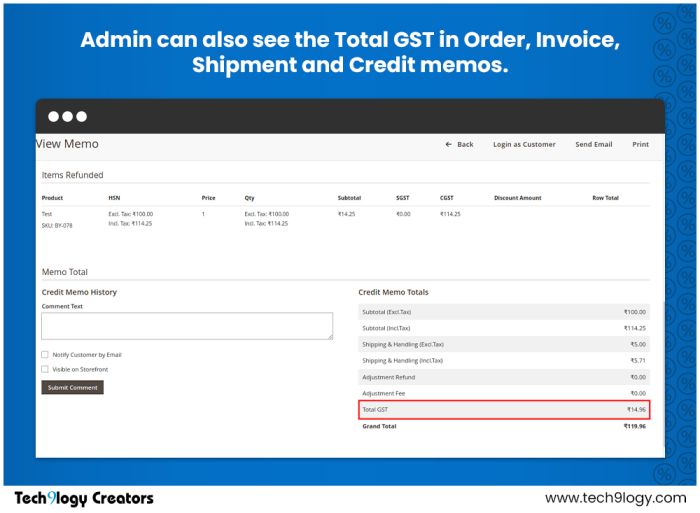

Enrich user experience by providing a detailed tax breakdown of products ordered from your Magento store. Admin can adjust the SGST/CGST from the comprehensive backend provided with our extension as per the customer’s region or pin code. Admin can also opt to display the HSN codes of products on their invoices.

Key features of Magento 2 GST Module

- Automate GST calculations on products purchased from your store.

- Instantly determine whether Intra-state tax(SGST+CGST) or Inter-state tax (IGST) applies to the order.

- Enable GST charges on the shipping cost of products.

- Set CGST/SGST for different states or pin codes as per the rules defined by the Government of India.

- Showcase GST breakdown on all orders, invoices, and their respective PDFs.